Attorneys and their clients need to understand the implications of assessing the potential economic damages in a case when an “individual” becomes a “business” since the damages calculation shifts from estimating lost “wages” to lost “net profit.”

For the W2 individual employee, the potential losses are losses of “wages, salaries, tips, etc.” that are entered on Line 7 of the Form 1040.

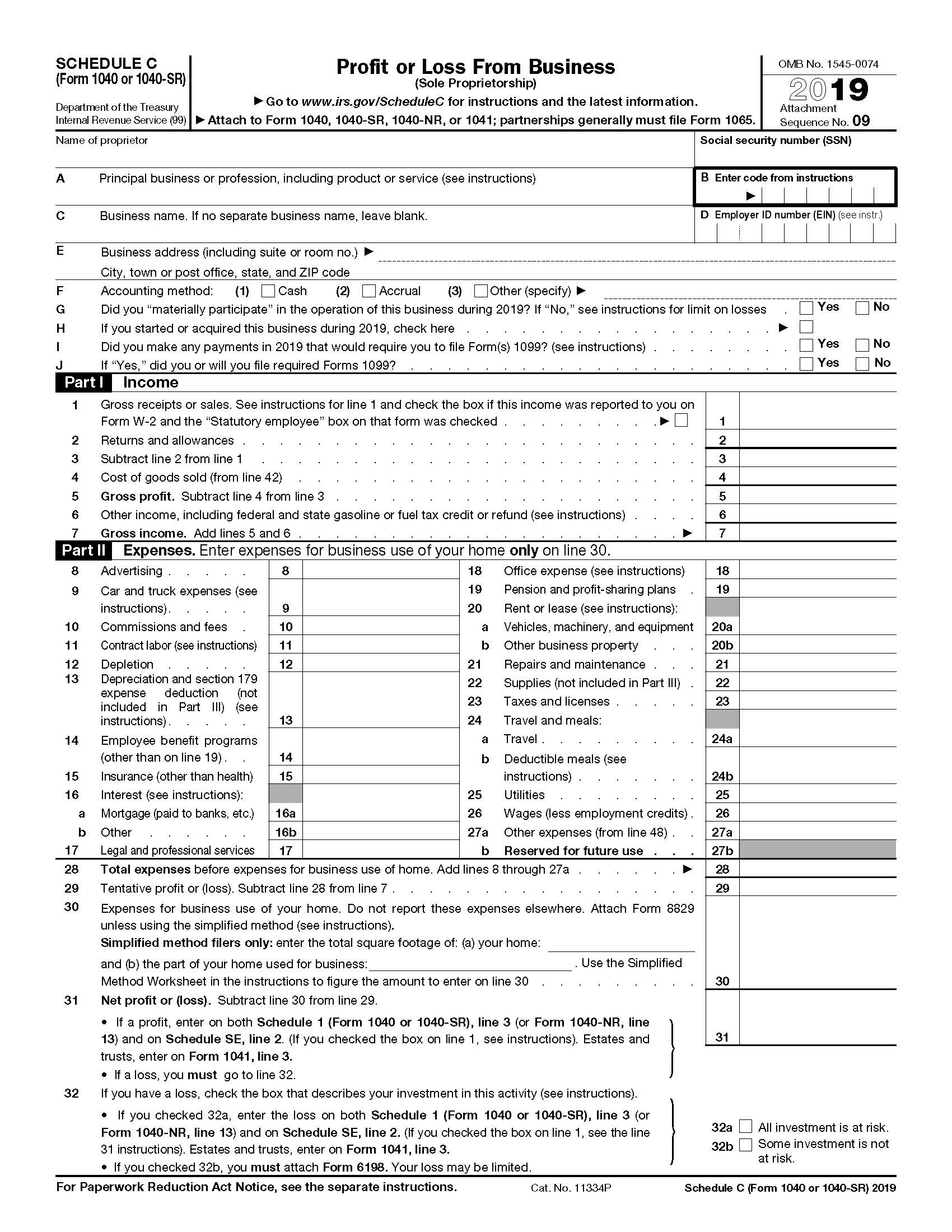

However, for the self-employed individual, the losses are “net profits” (revenues less expenses). The Schedule C is for sole proprietors and single-member limited liability corporations. Several self-employed individuals who are part of the “gig” or the “1099 economy” fall under these types of business since they are “independent contractors.” The Schedule E is for those who file as partnerships or who receive income from their S-Corporation.

Based on our experiences with independent contractors (particularly, Schedule C workers), it’s not unusual for them to thrive off of “cash flows.” They manage “day-to-day” and “month-to-month,” and can afford a “desired lifestyle” because part of the economic benefit of being self-employed is that some expenses making their lifestyle affordable are legitimately charged to the business thereby reducing their tax liability. For example, automobile and home office expenses that help with the affordability of a car or a house at the same time may reduce one’s tax liability.

However, as the ranks of the self-employed have been increasing and as they are incurring economic damages, we are finding many self-employed individuals are startled when they realize their potential economic damages may be limited to loss of net profit (Line 31 Schedule C), not the loss of revenues (Line 1 Schedule C).

For example, the self-employed individual may have gross revenues of $150,000, but their net profit rate may be 25% or $37,500. That amount would appear on Line 31 of the Schedule C and would be entered on Line 12 (Business income or loss) of the Form 1040.

However, while using business expenses to enhance lifestyle affordability may be a good tax strategy, if the self-employed individual suffers economic damages, they may be limiting the amount they can recover if recovery is limited to the loss of net profit. Consequently, attorneys may have to make the case their client is entitled to these “lifestyle expenses” (this is a term we use internally) – in addition to the recovery of net profits – to make their clients “whole,” financially.

In the District of Columbia, attorneys should also be aware some available “benefits” to the self-employed may include “tax savings” derived from (i) reductions to taxable income and (ii) tax credits. In Maryland and Virginia where earnings damages are calculated on pre-tax dollars, “tax savings” may not be a consideration.

In the case of the District, these reductions to taxable income are captured in Lines 23 to 37 (Adjusted Gross Income) of the Form 1040. Some deductions include health savings account (Line 25), deductible part of self-employment tax (Line 27), self-employed SEP, Simple and Qualified plans (Line 29).

A tax deduction reduces the amount of taxable income. For example, if someone is in the 15% tax bracket, for every $10,000 that “adjusts income,” self-employed filers will save $1,500 in taxes.1

A tax credit reduces, dollar-for-dollar, the amount of taxes due. For example, if after-deductions the amount of taxes owed is $13,000 and there is a tax credit of $3,000, the tax liability would be $10,000, a 23% reduction.

To calculate “adjusted gross income,” and to determine available tax credits, the attorney and client should get advice from a tax professional.

As the number of people who work in the “gig economy” increases, attorneys need to be aware of the level of the potential damages that can be recovered and how those damages are calculated.

While we have focused on “net profits,” there are also implications for work-life expectancy, growth rates, and discount rates for the self-employed.

Is my client an “employee” who receives “earnings” as noted on a Form W-2 or someone who is “self-employed” who receives has to file a Schedule C?

Will their potential losses be earnings or business income ones?

These are questions attorneys should be asking themselves as they assess a case for potential economic damages involving loss of wages or net profits.